What is a Big Tax Refund?

If we take away chattels depreciation, a tax refund means you are losing money. For example, if you are getting a $10,000 tax refund, in approximate terms it means you are losing $30,000. So, overall, you are still $20,000 down after tax.

I often use this example: If you want an extra $10,000 tax refund, then pay me $30,000 extra. Most people think about this for a while, before realising that it is a horrible idea, as you will be giving $30,000 to get back $10,000!

Whereas, if you have to pay $10,000 in tax, it is actually a good thing. It means you are making $30,000, then after paying $10,000 in tax, you still have $20,000 left.

It is important to understand your cash flow, and in my opinion, if you have negative rentals, you should have a 5 year plan to turn the loss into a profit, or at least break even. Especially with Ring Fencing looking like it will come in from 1 April 2019!

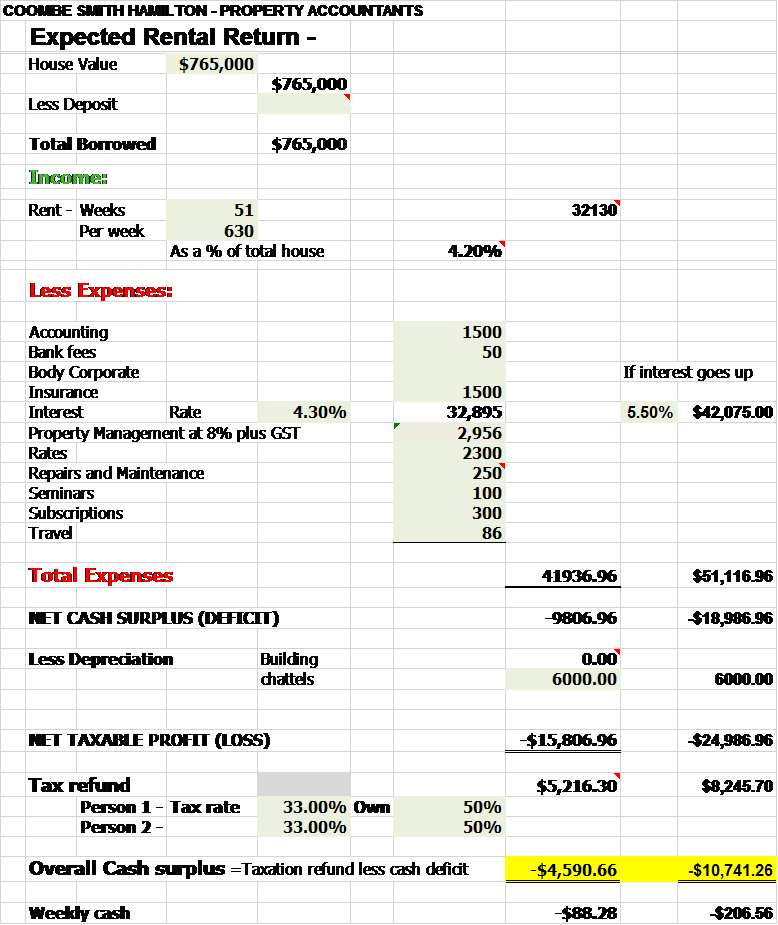

This is a rental property that a client looked at buying last week! I start off looking at the rental with 100% mortgage, and this is a very high loss at $9,807 per year. So when Ring Fencing comes in, that will be a $188 per week cash loss! This is a brand new property, so that is why repairs are so low, but I would often allow $2,000-$3,000 per year depending on the property. My numbers are in the spreadsheet below. This example shows a $5,216 tax refund under current rules which looks great but the investor would still be losing $4,591 after tax.

Hopefully you found this interesting.

Kind regards

Ross Barnett

Disclaimer: This article has been prepared for the purpose of providing general information, without taking into consideration any particular person's objectives, financial situation or needs. Any opinions contained in it are held by the author as at the report date and are subject to change without notice.

Lifetime Book Club: Stillness is the Key by Ryan Holiday

In a world that rewards speed, noise, and constant movement, this book offers a different perspective. One that suggests clarity, better decisions, and a more meaningful life do not come from doing more. They come from slowing down.

This is not a productivity hack or a call to retreat from real life. It is a thoughtful reminder that stillness is not weakness. It is a strength.

Mastering the New Year: The Psychology, Power, and Precision of Goal Setting

For many, the beginning of a new year signifies a fresh start, a blank canvas upon which we can paint our aspirations and ambitions. Goal setting is not just a yearly ritual; it is a powerful tool that empowers individuals to strive for personal growth, achieve milestones, and lead more fulfilling lives.