Lifetime Investment Philosophy (version 2.0)

Lifetime is truly up and running post its 2018 merger and now rolling out new and improved advice and investment training program for our advisers and administration staff.

Giving our clients advice and helping invest for their future is a critical part of what we do at Lifetime (and Camelot prior). With the addition of new advisers from the merger, it was a perfect time for our investment committee to sit down and revisit our investment philosophy to see if there was anything we could refine or better explain to our new advisers and ultimately to you, our clients.

Our Guiding Principles

At Lifetime we understand there is a balancing act between risk and return. It is our belief that short-term market fluctuations cannot be accurately or consistently predicted and therefore look to long-term market characteristics which are measurable and definable. We have decided to remove emotion and use evidence-based academic research to underpin our investment philosophy.

These guiding principles have helped us to identify the pillars to our investment philosophy which we have developed over the years and will continuously do so in the future.

Our Investment Philosophy

An investment philosophy is the theory that acts as the framework that informs and shapes the investment decision-making process. It is something investors need to stick to once they start investing.

Our investment philosophy is therefore based on the following pillars:

- Investment risk can be mitigated with true diversification.

- We understand that to achieve higher returns, volatility is accepted.

- Successful investing requires patience and discipline over the long-term.

- We believe that over the long-term, equities will out-perform cash, term deposits, and bonds.

We then decided to select an appropriate diagram to help explain the key concept for each of the individual pillars:

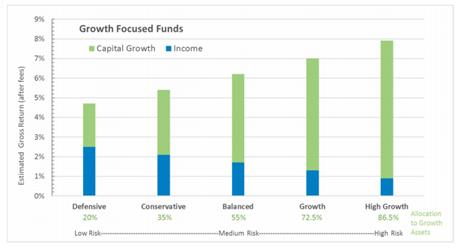

1. Risk can be mitigated with true diversification

2. We understand that to achieve higher returns, volatility is accepted

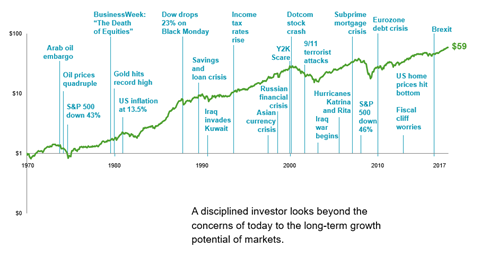

3. Successful investing requires patience & discipline over the long-term

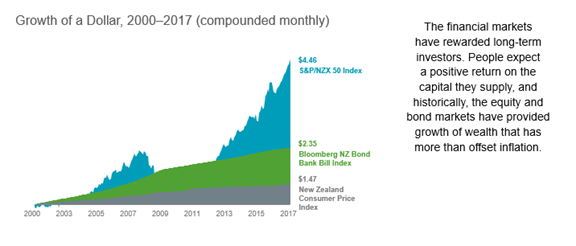

4. We believe that over the long-term, equities will out-perform cash, term deposits, and bonds

Conclusion

Having both a sound and proven investment philosophy helps Lifetime provide certainty to you, our clients. Providing certainty is what we strive to deliver and is consistent with how we have structured our client-focused planning process.

By sharing our Investment Philosophy story, we hope this has helped you understand how we try to consistently add value to your experience with Lifetime.

As always, if you have any questions and would like to discuss this further, please speak to your financial adviser.

Disclaimer: This article has been prepared for the purpose of providing general information, without taking into consideration any particular investor’s objectives, financial situation or needs. Any opinions contained in it are held as at the report date and are subject to change without notice. This document is solely for the use of the party to whom it is provided.

Lifetime Book Club: Stillness is the Key by Ryan Holiday

In a world that rewards speed, noise, and constant movement, this book offers a different perspective. One that suggests clarity, better decisions, and a more meaningful life do not come from doing more. They come from slowing down.

This is not a productivity hack or a call to retreat from real life. It is a thoughtful reminder that stillness is not weakness. It is a strength.