Investment Update November 2018 - A Holiday Perspective

Those who have been following share markets will know that returns during 2018 have been more variable (both up and down) than in the few years prior, which were unusually smooth.

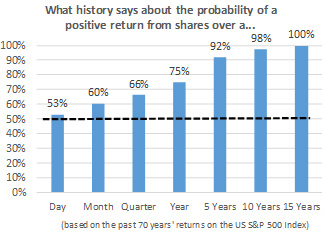

With plenty happening during the year, the temptation to keep a very close eye on investment returns is high. At first glance it might therefore seem a little worrying that only just over half of the days this year have delivered a positive return for shares. But this is exactly in line with history. Over the past 70 years, ‘only’ 53% of days have seen a market rise. Put another way, when you look at the share market on any given day, whether it’s gone up or down is pretty much a coin toss.

Put that together with our emotional tendency as humans to feel twice as much pain from a loss as we do pleasure from a gain. It is then clear that someone who checks their investment balance every day is not going to have a very pleasant time!

It gets better though. Despite ‘only’ rising on 53% of days, someone who just checked in annually would have seen a positive return 75% of the time. This rises to 98% of 10-year periods and all 15-year periods, reaffirming that most short-term returns are ‘noise’ for someone with a long timeframe.

In investing, like in many things in life, the best way to have a good experience is to have the right perspective.

In investing, like in many things in life, the best way to have a good experience is to have the right perspective. Thinking about it this way, long-term saving, and investing has some similarities to going on holiday. When you have packed up and headed out on the road to your destination, if you run into roadworks on the way, you are unlikely to respond by turning the car around. And when you get there, with glass of wine in hand, you probably will not call the cattery or dog kennel each day to see how the pets are getting on either.

So, feel free to sit back this summer – if your investment approach (or retirement plan) has been designed with your financial adviser to be in line with your timeframe, goals and ability to ride out shorter term ups and downs, then your portfolio will thank you for it.

Article by Joe Byrne, BA, AFA - Read More

Disclaimer: This article has been prepared for the purpose of providing general information, without taking into consideration any particular investor’s objectives, financial situation or needs. Any opinions contained in it are held as at the report date and are subject to change without notice. This document is solely for the use of the party to whom it is provided.

Maximise Your Miles: Financial Tips for Frequent Flyers

Whether you’re a young Kiwi planning your OE (overseas experience), a family about to embark on that long-awaited trip to Disneyland, or a seasoned business traveller hopping between meetings in Singapore and Sydney, the excitement of travel is unbeatable. But with every adventure comes a bit of financial planning to ensure your holiday memories aren’t clouded by an unexpected hit to the wallet.

Market & Portfolio Update - January 2026

After strong gains in 2025, the global share market (represented by the MSCI World Gross Index) took a breather in January, returning 0.1% in NZ dollar terms. While the ‘Magnificent 7’ (the seven largest US-listed companies, including Google, Microsoft & Apple) have been large drivers behind the recent gains seen from the US share market, January told a different story. There appeared to be ‘catch-up’ trade where investors moved out of concentrated tech positions and into the rest of the market, with the Russell 2000 index (a widely regarded proxy for smaller US companies) having a strong month. This was generally seen as improving confidence in the broader US economy.