Health Feature; Coeliac Disease & Financial Risk Protection

As a Coeliac and a Financial Adviser, I have been asking myself several questions about how best to protect myself and my Coeliac daughter from the financial effects of any future illness. Additionally, how much do insurance companies actually understand about Coeliac Disease? And how do they treat us when it comes to assessing our risks of ill health?

The following is designed to be a simple, yet helpful analysis of some research I have undertaken in the area of personal insurances for those with Coeliac Disease. Please note that I am not a qualified medical practitioner. To conduct this research, I have utilised my 20 years’ experience as a Financial Adviser along with my personal understanding of Coeliac Disease and specific discussions with New Zealand insurance companies in the preparation of this article.

It is also important to note that this article and my findings only deal with a diagnosed Coeliac who is living a healthy gluten-free lifestyle.

The Key Questions I will address are:

- As a Coeliac do I have a higher need for insurance than the average population?

- How will insurance companies assess me as an insurable individual given I am a Coeliac?

- What should I look for in insurance policy wordings to better suit my condition?

Do Coeliacs have a higher need for insurance?

There are two components to a person’s need for insurance. The first is the same for people of all health and is purely based on financial needs. Namely, to what degree do you rely on your ability to earn an income, do others rely on your income and how quickly will your earnings return when you recover? A qualified Financial Adviser should be able to adequately assess your capital needs for the different types of personal insurance, and consider all aspects of your financial position including (but not limited to): Your debt, income and progress towards retirement.

The second component is the likelihood of a claim. It is this aspect that I have a bigger personal concern with as a Coeliac, given it might increase my need for insurance covers; for example:

As a Coeliac and a Financial Adviser, I have been asking myself several questions about how best to protect myself and my Coeliac daughter from the financial effects of any future illness.

Health Insurance

I am already having teeth issues, and I know that Coeliacs have higher instances of dental enamel defects. So, should I have added a dental cover to my health insurance? This isn’t something I would typically advise my healthy clients (because the premium may not justify having this benefit) but it is just one of many unique considerations that exist for those with Coeliac Disease.

As a Coeliac I have also had more than my fair share of gastroscopies, something I fortunately haven’t had to hesitate on doing thanks to the fact I have had personal health insurance to cover private procedures and give me access to my choice of specialists. This is not to say the public health system doesn’t provide more than adequately for Coeliacs – it’s just easier with a health insurance policy as you don’t have to suddenly find money to cover unexpected costs or endure longer waiting lists.

For these reasons I feel private health insurance is more important for those with Coeliac Disease than the average population.

Income & Mortgage Protection

Perhaps the most crucial insurance for all income earners is income or mortgage protection. This coverage pays if you are unable to work due to injury or illness. Typically, it is for longer periods off work than a few days with an upset stomach and lethargy, but issues such as depression are a significant reason for claims and unfortunately, depression is an associated condition of Coeliac Disease and other long-term illnesses.

Whilst I am unable to find specific research into the amount of time off work due to Coeliac Disease or associated conditions, a look at the claims statistics1 for the general New Zealand population gives us an indication as to what may prevent any of us from working for a material point of time.

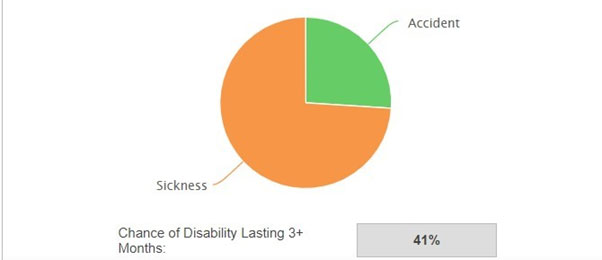

Firstly, for a 40-year-old male:

- Sickness is by far the most likely factor to cause you a disability.

- There is a 41% chance of a disability that lasts longer than 3 months.

- 26% of males will make claim before they are 65 years old.

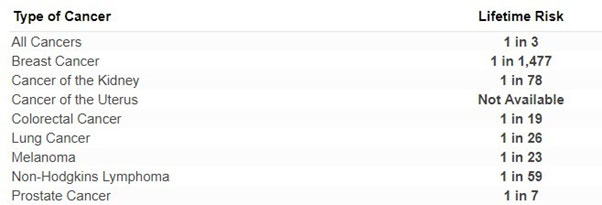

- 1 in 3 males will contract a form of cancer before they are 75 years old.

Most Likely Factor To Cause You A Disability

General Probability Of Claiming On A Policy by 65

Lifetime Risk Of Acquiring A Cancer Before 75

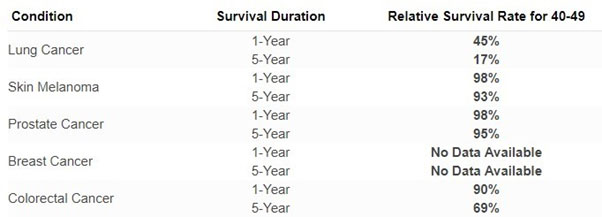

Relative Survival Rate For A Cancer

For 40-year-old females:

- Sickness is by far the most likely factor to cause you a disability, even more likely than with males.

- There is a 43% chance of a disability that lasts longer than 3 months.

- Almost 22% of females will make claim before they are 65 years old.

- 1 in 4 females contract a form of cancer before they are 75 years old.

Most Likely Factor To Cause You A Disability

General Probability Of Claiming On A Policy by 65

Lifetime Risk Of Acquiring A Cancer Before 75

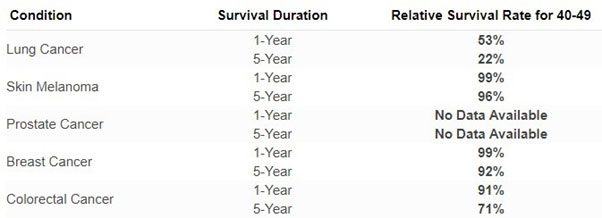

Relative Survival Rate For A Cancer

Coeliac Disease, just like any other autoimmune disease or long-term illness, further increases the chance of “sickness” and disability, including inability to work for a period of time, then you can see how important it is to consider things like income and mortgage protection when protecting you and your family’s future.

I have long been of the belief that income protection is for the majority of people. It is the most important insurance and I believe it is even more important for Coeliacs based on the information above.

Life Insurance

Coeliac Disease is not a fatal disease in itself but if it is not treated with an exclusively gluten-free diet, can increase your chances of fatal diseases like bowel cancer.

It therefore follows that Coeliacs who are following a 100% gluten-free diet would have no greater need for Life Insurance than the normal population. However, Coeliacs who don’t adapt their diet may have an increased medical risk which should not be overlooked.

Potentially of interest, there are also some insurance products that pay lump sums in the event of major health conditions. The common conditions covered are outlined on the following page. I have highlighted some of the specific conditions that a Coeliac may be more likely to contract.

It is important to note that insurance of any type is not priced for people to profit from. If cover is granted at standard prices to Coeliacs, and the cover is required to meet your financial needs and personal risk management plan, then it should be used by Coeliacs.

Trauma cover conditions - full benefit conditions:

- Accidentally acquired HIV

- Alzheimer’s disease

- Angioplasty-triple vessel*

- Aorta surgery*

- Aplastic anaemia

- Benign brain tumour or benign spinal tumour

- Cancer*

- Carcinoma in situ- major treatment*

- Cardiomyopathy

- Chronic kidney failure (renal failure)

- Chronic liver failure

- Chronic lung disease

- Cognitive Impairment

- Coma

- Coronary artery bypass surgery*

- Creutzfeldt-Jakob disease (CJD)

- Dementia Encephalitis

- Heart attack*

- Heart valve surgery*

- Intensive care

- Loss of independent existence

- Loss of limb and eye

- Loss of limbs

- Loss of sight in both eyes

- Loss of speech

- Major head trauma

- Major organ transplant*

- Meningitis and/or meningococcal disease

- Motor neurone disease

- Multiple sclerosis

- Muscular dystrophy

- Occupationally acquired HIV

- Open heart surgery

- Out of hospital cardiac arrest*

- Paralysis

- Parkinson’s disease

- Peripheral neuropathy*

- Pneumonectomy

- Primary pulmonary hypertension

- Severe burns

- Severe diabetes

- Severe inflammatory bowel disease*

- Stroke*

- Systemic sclerosis

- Total deafness in both ears

- Partial benefit conditions

- Adult onset type 1 insulin dependent diabetes mellitus*

- Alzheimer’s disease diagnosis

- Aneurysm

- Angioplasty-two vessels or less*

- Carcinoma in situ-without major treatment*

- Chronic lymphocytic leukemia*

- Colostomy and/or ileostomy*

- Dementia diagnosis

- Early stage prostate cancer*

- Hydrocephalus

- Loss of one limb

- Loss of sight in one eye

- Major burns

- Malignant melanoma diagnosis*

- Multiple sclerosis diagnosis

- Parkinson’s disease diagnosis

- Severe osteoporosis*

- Severe rheumatoid arthritis

- Systemic lupus erythematosus

- Total deafness in one ear

* Three-month stand-down from the cover commencement date applies. Refer to the Policy Wording for full definitive details and conditions.

How do insurance companies treat Coeliac Disease?

Insurance companies are not medical experts, they do not represent themselves as making specific diagnostic assumptions. Instead, they are driven by an actuarial process that sets standard health conditions for a certain age then measures variances away from that standard health definition. They then look to protect the collective insured population from being unfairly disadvantaged from those who have an increased risk of claim due to having non-standard health.

A simple example best illustrates this: Smokers usually pay twice as much for the same cover as non- smokers as they are twice as likely to claim. Alternatively, an insurance company may exclude a health condition or cause of death from being covered. So, a cancer survivor may be offered life insurance with a specific term that says that if the cause of death is cancer then the cover will not be offered.

Of particular interest to me as a Coeliac is to what degree insurance companies see me as being different to someone of standard health. If I am concerned about my risk of additional health risks but they are not as concerned or perhaps even aware, then I am getting a better than average deal and perhaps this particular arbitrage may not exist in the long-term as the insurance world better understands the link between Coeliac Disease and other conditions.

So, I requested the current underwriting policies for a healthy Coeliac following a gluten-free diet from New Zealand’s major insurance companies.

The results are summarised on the following table and as you will see there are some variations between them that are worth considering:

|

Provider |

Insurance Cover |

|

Fidelity Life |

Standard Rates for Income Protection, Trauma and Life |

|

Asteron Life |

Standard Rates for Income Protection, Trauma and Life |

|

Accuro Health Insurance |

Exclude any Coeliac conditions for the first 10 years |

|

Southern Cross |

Did not respond |

|

Sovereign |

Standard Rates for Trauma and Life after symptom-free for 4 years after diagnosis. Some loadings for shorter wait period for Income Protection. Excluded for Health Insurance |

|

Partners Life |

Standard Rates for Income Protection, Trauma and Life. Excluded if had symptoms or relate treatment in the last 5 years otherwise covered. |

|

OnePath/Cigna |

Standard Rates for Income Protection, Trauma and Life if 6 months after diagnosis. 50% loading for Income Protection and TPD. |

|

NIB Health Insurance |

Excluded for Health Insurance |

|

AIA |

Standard Rates for Income Protection, Trauma and Life after 12 months since diagnosis and possible loading of 50% on Income Protection. Excluded for Health Insurance |

Note that insurances provided as part of an employment package in a group scheme often removes the need for personal insurances, this may be the best way for Coeliac sufferers to get cover, especially health cover.

What should I look for in insurance policy wording to better suit my condition?

Risk Researcher is a software provided by Australasia’s biggest insurance software and database provider Iress. Using this research tool, we have isolated specific areas of insurance contracts that may be more important for people with Coeliac Disease.

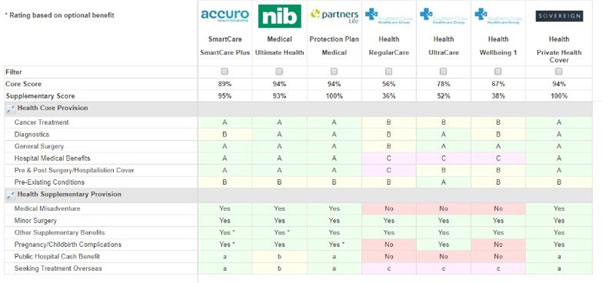

Our first cover type is Health Insurance. You will see on the chart below, specific cover features are rated on an A, B, C scale. Those policies with more A ratings achieve a higher core score which means they offer more comprehensive cover in Coeliac specific conditions (with reference to Dr Jason Tye-Din’s presentation at last year’s Coeliac NZ Conference).

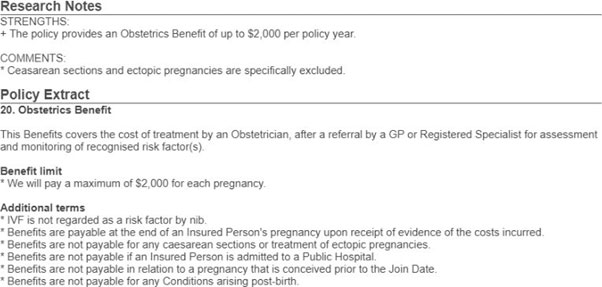

A further illustration of the differences between policies is the Obstetrics Benefit (see example below) which some offer while others don’t. This is particularly relevant to females as Coeliac Disease can cause birth complications.

Reference: Iress Risk Researcher Software Package, June 2019

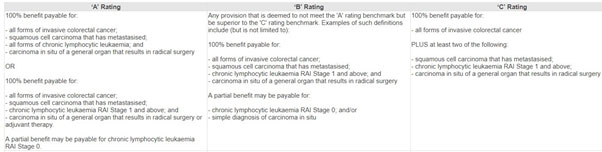

Now if we look at Trauma Insurance - we see very little difference in the policies available in the market but as bowel cancer is an increased risk for those with Coeliac Disease, I would again suggest that Coeliacs look for A ratings in the Benefit Clause of “Cancer (General)”.

What constitutes an A rating for Cancer definition?

Finally; Income Protection Insurance. This is where we see the greatest variance in income protection policies based on the conditions we have isolated as being particularly important to Coeliacs. These are outlined in the below table:

Summary

In this article I have simply tried to alert people to the differences between a Coeliac’s need for insurance and the general population.

The general population already has a considerable need for good, fit for purpose insurance but for Coeliacs there are some considerations beyond just diet that we should be aware of to protect ourselves and our financial wellbeing in the future.

I would be more than happy to discuss this paper with you personally, otherwise feel free to contact your local Lifetime Adviser.

Article By Sam Walter - Read More

About the Author

Sam Walter is an Auckland based Financial Adviser who has been supporting clients with their insurances and investments for nearly 20 years. Sam has over $90 million worth of private funds under his management and is great at motivating people to improve their financial behaviours.

Diagnosed as a Coeliac in 2008, aged 30, Sam is a long-term member of Coeliac New Zealand and active supporter of their Dining Out Programme. Together with his 10-year-old Coeliac daughter Sophie they are hugely passionate about helping those new to Coeliac Disease to embrace their new lifestyle.

References:

1. Iress Risk Researcher Software Package, June 2019

Lifetime Book Club: Stillness is the Key by Ryan Holiday

In a world that rewards speed, noise, and constant movement, this book offers a different perspective. One that suggests clarity, better decisions, and a more meaningful life do not come from doing more. They come from slowing down.

This is not a productivity hack or a call to retreat from real life. It is a thoughtful reminder that stillness is not weakness. It is a strength.