Free lunch? Make sure you get yours

In today’s busy and complicated world, there are not too many free lunches available but if you look carefully, you may be able to find one!

I would consider KiwiSaver member tax credits as close to a free lunch as you can get. For those KiwiSaver investors between the ages of 18 and 64 and who contribute at least $1,042.86 to their KiwiSaver account for the year ending 30th June, the Government will give them $521 as a member tax credit each year. Translated into English, if you have contributed at least $1,042.86 into your KiwiSaver account during the year, the Government will transfer $521 cash, into your account. That’s it!

KiwiSaver accounts are locked-in until you reach the age of eligibility for New Zealand Superannuation (currently 65) or completing five years’ membership if you joined after age 60 – you will also enjoy member tax credits during these five years

The Government will give you 50 cents for every dollar you contribute up to $521, so it makes a lot of sense to ensure you have contributed enough to maximise your benefit. The government will do this for you each year. To maximise these tax credits and contribute the $1,042.86 amount, an investor would only have to contribute $20.06 per week. Most providers recommend you top up by the 25th June, to allow for processing.

Unfortunately, not all KiwiSaver members are taking advantage of this opportunity. Some of the large banks have indicated last year that only around 50-55% of their KiwiSaver members are getting the maximum benefit. That’s about $400 million that Kiwis are missing out on.

How do the numbers stack up?

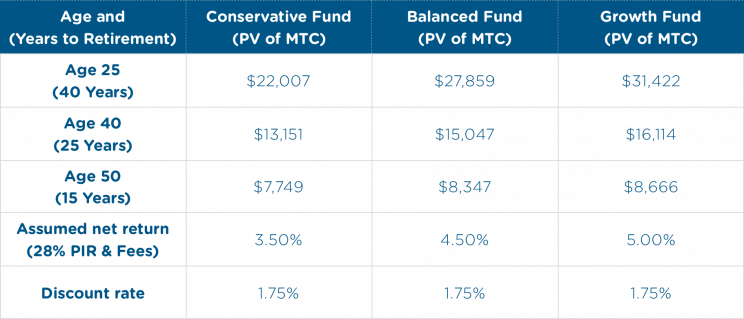

Table 1. Here are the present values (today’s dollars) for just the government’s $521-member tax credit (MTC) over different working careers and retiring at age 65 (i.e. years-to-retirement).

Chart 1. Growth of $10,000 Chart (with employee, employer and government contributions)

Chart 1 assumptions: Growth of $10,000 invested in a KiwiSaver Balanced Fund at age 40 with 25 years of investing to the retirement age of 65, employee and employer contributing 3%, $75,000 annual salary, 2% assumed inflation, 28% PIE tax rate, investment management fees of 1.20% and receiving the full $521-member tax credit.

Will you receive your full entitlement of $521? If not, you should consider topping up your KiwiSaver account today (you have until the end of June).

Enjoy your ‘free’ lunch!

Give your financial adviser a call if you have any questions on this and or if you need any advice or help making lump sum contributions to your KiwiSaver account.

Lifetime Book Club: Stillness is the Key by Ryan Holiday

In a world that rewards speed, noise, and constant movement, this book offers a different perspective. One that suggests clarity, better decisions, and a more meaningful life do not come from doing more. They come from slowing down.

This is not a productivity hack or a call to retreat from real life. It is a thoughtful reminder that stillness is not weakness. It is a strength.

Mastering the New Year: The Psychology, Power, and Precision of Goal Setting

For many, the beginning of a new year signifies a fresh start, a blank canvas upon which we can paint our aspirations and ambitions. Goal setting is not just a yearly ritual; it is a powerful tool that empowers individuals to strive for personal growth, achieve milestones, and lead more fulfilling lives.